Forget everything you know about traditional SEO. When users ask platforms like ChatGPT, Perplexity, or Gemini to recommend the “best mobile bank” or “top credit building apps,” they’re met with curated answers from a small set of trusted brands. These models don’t index the full internet. They summarize. They rank. They gatekeep.

And in Q1 2025, only 10 digital banks controlled over 83% of that visibility.

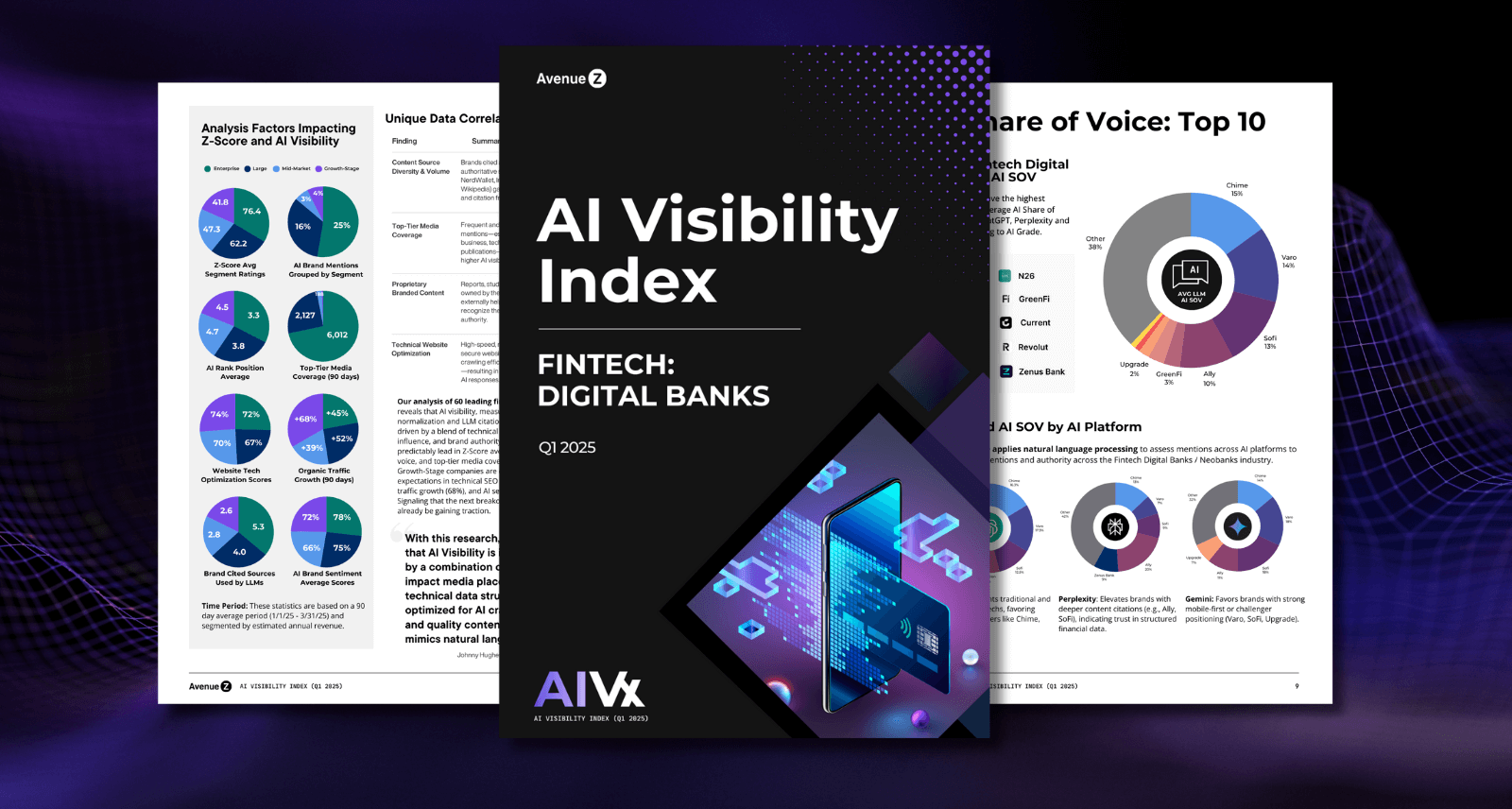

Welcome to the AI Visibility Index for Digital Banks: a data-driven benchmark that reveals which digital banking brands are surfacing in AI search, what signals drive inclusion, and why most of the industry is being left out.

Ranking the Top Digital Banks by AI Visibility

We’ve analyzed 60 fintech Digital Banks / Neobanks to uncover who leads in AI visibility across ChatGPT, Perplexity, and Gemini, and why most are falling behind.

Table of Contents

What Is the AI Visibility Index?

Avenue Z developed the AI Visibility Index to help brands understand where they stand in this new era of discovery, and how to improve their positioning.

We analyzed 60 digital banking and neobank brands over a 90-day period across more than 100 real-world AI prompts. Our proprietary Z-Score tracks brand visibility across ChatGPT, Perplexity, and Gemini, measuring how often each brand is mentioned and cited in AI-generated responses. It also weights technical site performance, sentiment, content footprint, and media authority.

This isn’t just an SEO report; it’s a snapshot of how AI systems are reshaping digital competitiveness.

What Signals Drive AI Visibility for Digital Banks?

Our analysis revealed five dominant power signals that consistently influence whether a digital bank appears in AI-generated results:

- Content Quality and Relevance: AI models prioritize well-written, relevant, and up-to-date content. Brands that maintain clarity, depth, and usefulness across their pages earn higher placement.

- Credible Mentions and Sources: Visibility increases when third-party sites mention your brand. This includes citations in articles, user reviews, blogs, and forums—especially when those mentions come from top-tier publications or trusted domains.

- Topical and Structured Content: AI systems reward focused, well-organized content. Structured data, schema markup, and clearly themed content clusters help your pages become more machine-readable and answer-ready.

- Diverse, Authoritative Content Types: From first-party research and financial tools to FAQ pages and explainers, successful banks create a mix of useful assets that build authority and train AI to trust your brand.

- Technical Performance and Trust Signals: Mobile-first design, fast load speeds, and strong security protocols are no longer optional—they directly affect how often AI models surface your content. Sites that demonstrate credibility and performance earn more trust.

What the Data Reveals

- Just 10 brands own almost 84% of AI search share of voice.

- 23% of brands didn’t appear in a single AI-generated answer.

- Neobanks dominate: 8 out of ChatGPT’s top 10 most visible banks are fintech-born.

- Legacy banks are falling behind, despite massive traffic and brand recognition.

- Positive sentiment isn’t enough. Many highly trusted brands still don’t show up at all. Visibility, not vibes, is what matters in AI.

Why Digital Banks Should Care

AI is not the future of search; it’s already the present.

According to Gartner, traditional search volume is projected to drop 25% by 2026 due to AI platforms replacing keyword-based discovery. That means less traffic from Google and more customer journeys beginning (and ending) with ChatGPT, Gemini, and beyond.

If your brand isn’t showing up in AI search, you’re invisible at the most important point of influence.

Who Are the Key Players?

The digital banks leading in AI visibility are not just popular. They are optimized. Brands like Chime, SoFi, and Capital One consistently rank because they pair strong technical performance with clear, trusted content. Others, like Brex and Nubank, are growing quickly but have yet to break through in AI search.

Some brands fall into what we call the Opportunity Zone. They are underperforming in both visibility and growth but have the potential to improve. With the right strategy, these brands can still gain traction.

What Digital Banks Can Do Right Now

To increase visibility in AI search, digital banks should:

- Audit their content footprint to ensure it includes structured product pages, FAQs, and AI-friendly language.

- Invest in technical SEO and mobile-first site performance.

- Secure coverage in AI-cited media outlets like NerdWallet, Bankrate, and Business Insider.

- Track AI search presence and use visibility as a new KPI for brand awareness and competitive share.

- Align messaging around 1–2 clear, repeatable differentiators that AI models can associate with user intent.

Want to See Where You Rank?

Download the full report to see how 60 leading digital banking brands perform in AI search—and what it takes to compete.

Request a custom visibility audit to see how your brand stacks up—and what you can do to improve.

Questions about AI Optimization? Contact our team for a tailored strategy to grow your presence in AI-driven discovery.