See Which Multivitamin Brands Rank in AI

AI is reshaping how brands are found – dictating what consumers see, trust, and ultimately buy. Visibility within AI systems now impacts every stage of the customer journey, influencing traffic, reputation, and revenue.

Stocked by AI: Multivitamin Brands That Make It to the Shelf

AI-powered search has become a new front door for supplement discovery. When consumers ask tools like ChatGPT, Perplexity, or Google AI Overviews which multivitamins to choose, they are consistently presented with a small set of brands that capture the majority of attention.

We analyzed 82 leading multivitamin brands across the top AI platforms, weighting ChatGPT at 50 percent, Google AI Overviews at 30 percent, and Perplexity at 20 percent. The results show a concentrated landscape where a handful of brands capture most of the mentions while many others remain invisible.

The Big Picture: Visibility Is Uneven

AI assistants do not distribute attention equally. The top 10 multivitamin brands captured nearly two thirds of all AI mentions while more than 20 percent of brands did not appear even once.

This suggests that in AI search the difference between being highly visible and being completely absent is stark. Only the brands with strong digital presence, reputation, and credibility signals are consistently surfaced.

Three Stats That Say It All

85%

Nature Made appeared in 85 percent of AI responses, the highest visibility of any brand in this category.

67%

The top 10 brands accounted for two thirds of all multivitamin mentions across AI platforms.

20%+

Nearly one in five brands studied had zero presence in AI generated search answers.

What Drives Visibility in AI Search

Several factors emerged as especially influential in determining which multivitamin brands AI tools include in their answers.

Authoritative Coverage

Brands featured regularly in “best of” lists, product roundups, and expert reviews gained consistent mentions.

SEO and First Party Content

Google AI often cited brand websites directly for factual details such as ingredients or certifications.

Reputation and Buzz

Brands with strong consumer chatter, positive reviews, and influencer attention, such as Ritual and Thorne, were prioritized by AIs.

Breadth and Fit

Brands with broad product ranges or clear niche offerings like prenatal, vegan, or personalized packs had an edge across different query contexts.

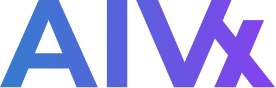

Visibility vs. Sentiment: A Telling Correlation

One unique finding from this study is that visibility and sentiment do not always move together.

The chart shows that visibility and sentiment do not always align. Nature Made is the most visible brand, appearing in 85 percent of AI results, but its sentiment score of 80 lags slightly behind peers. In contrast, Ritual has the strongest sentiment at 86 despite lower visibility, signaling growth potential as positive perception often translates into future visibility gains.

Thorne and Garden of Life illustrate two different paths. Thorne maintains both strong visibility and sentiment, making it a balanced leader, while Garden of Life remains widely mentioned but with a lower sentiment score of 78, suggesting that frequency of coverage alone does not guarantee enthusiastic framing.

What stands out is that AI tends to ignore poorly regarded brands rather than surface them negatively. This makes invisibility more damaging than mixed reviews, since absence in AI answers removes a brand from consumer consideration altogether. For newer players, strong sentiment can be an early signal of momentum, while for legacy brands, sustaining both high visibility and positive tone is key to long-term relevance.

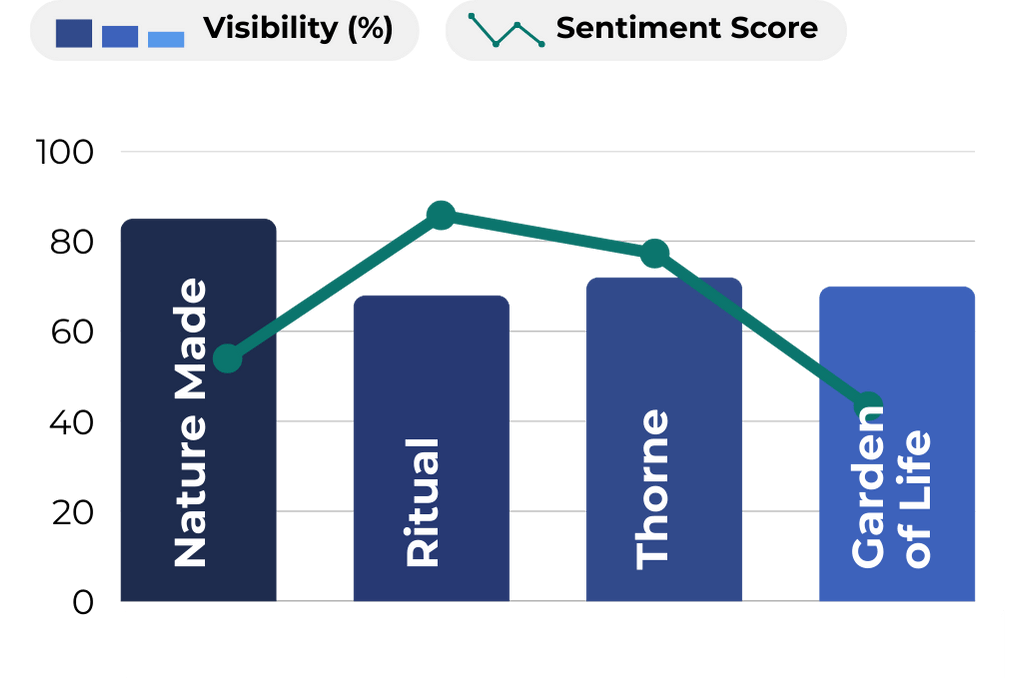

Source Type by LLM

We categorized sources into four main types and tracked their share across platforms.

- Editorial: Independent publishers and expert reviews such as Men’s Health, Healthline, and Forbes.

- Owned/Corporate: Brand websites and product pages such as NatureMade.com or Ritual.com.

- UGC (User Generated Content): Reddit threads, forums, and consumer comparison blogs.

- Institutional: Hospitals, universities, and medical centers that provide clinical authority.

Patterns by LLM show distinct preferences:

- ChatGPT leaned overwhelmingly on editorial sources, about 77 percent, with minimal reliance on brand-owned sites (13 percent) or institutional content (2 percent). This suggests ChatGPT is designed to reflect broad consensus from trusted media rather than direct brand claims.

- Perplexity showed a near 50–50 split between editorial (47 percent) and owned or corporate sources (47 percent). This balance highlights Perplexity’s tendency to mix third-party reviews with brand-provided information, a pattern that makes it more transactional and fact-driven than ChatGPT.

- Google AI demonstrated the most diverse sourcing, with editorial (47 percent), owned content (43 percent), UGC (3 percent), and the highest proportion of institutional references (6 percent). Its willingness to include hospitals and universities points to an added layer of health credibility in its recommendations.

Key Insight: While ChatGPT echoes media consensus, Perplexity blends brand and review sources, and Google AI triangulates across media, brand, and clinical authority. For multivitamin brands, this means visibility strategy cannot be one-size-fits-all — you need coverage in editorial articles, optimized brand content, and health authority references to ensure representation across all three platforms.

Unique Platform Factors Worth Noting

Each AI platform has a distinct way of sourcing and surfacing information, which creates important differences in how multivitamin brands are presented. Understanding these nuances can help brands tailor their strategy to the platforms where they seek visibility.

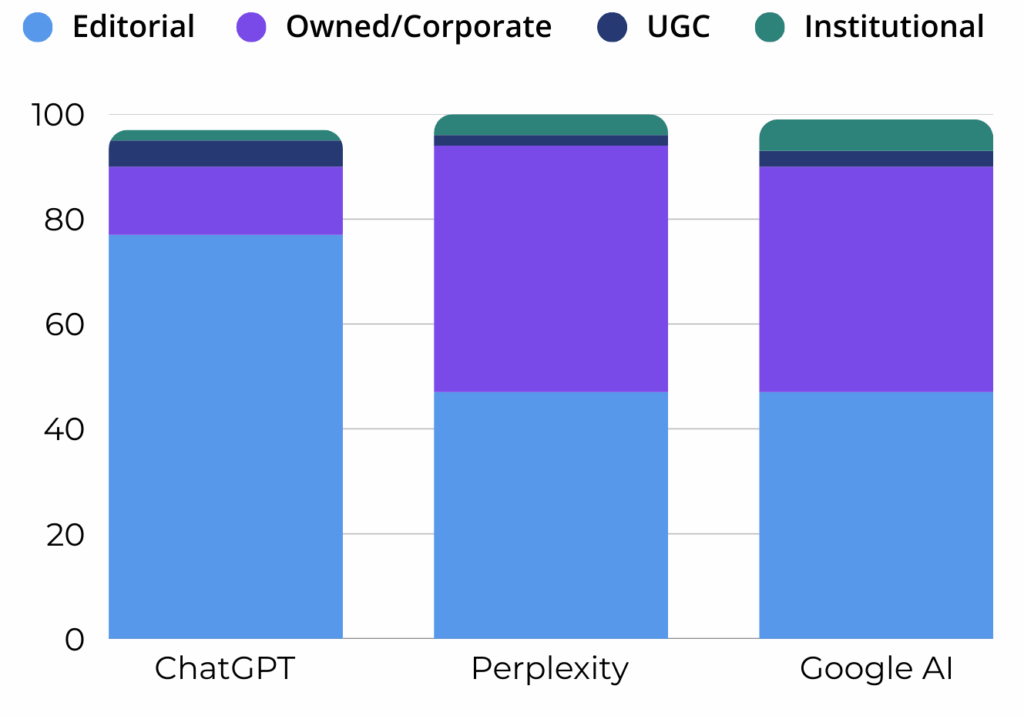

ChatGPT favors breadth, citing a wide array of editorial content without much repetition. It relies on consensus across reviews and articles rather than individual brand websites.

Perplexity leans toward data heavy sources, often pulling from market research firms and brand fact sheets alongside expert reviews.

Google AI integrates brand owned and institutional sources more than the others, reflecting its push to blend credibility, accuracy, and accessibility in its answers.

The takeaway is that no two AIs trust the same type of content equally. Brands that want to increase their visibility need to diversify their approach, ensuring they appear in editorial reviews, structured first party content, and authoritative health sources that align with each platform’s preferences.

Unique Platform Factors Worth Noting

AI search is already influencing how consumers discover and evaluate multivitamin brands. The winners, including Nature Made, Garden of Life, Thorne, and Ritual, have built strong reputations, created credible content, and secured coverage across authoritative sources.

For brands that lag behind, the path is clear. Invest in authoritative mentions, build well structured first party content, and create the kind of reputation signals that AI platforms cannot ignore. In a crowded and health focused category, if AI assistants are not talking about your brand, consumers likely are not either.

Download AI Visibility Report

Top Multivitamin Brands

AI Z-Score Performance Rankings