See Which Protein & Performance Brands Rank in AI

AI is reshaping how brands are found – dictating what consumers see, trust, and ultimately buy. Visibility within AI systems now impacts every stage of the customer journey, influencing traffic, reputation, and revenue.

Shaping Strength in AI Search: A Visibility Study of Protein & Performance Brands

AI search is quickly becoming the front door to product discovery. Whether it is ChatGPT recommending supplements, Perplexity surfacing curated reviews, or Google’s AI Overviews pulling structured brand content, the question is: which protein and performance nutrition brands are being surfaced most often, and why?

We analyzed 43 leading brands across ChatGPT, Google AI Overviews, and Perplexity, applying weighted importance (ChatGPT 50 percent, Google AI Overviews 30 percent, Perplexity 20 percent). The results show that AI visibility is far from evenly distributed, and success depends heavily on how and where brands show up across the digital ecosystem.

Executive Summary

AI search results for Protein and Performance supplements cluster strongly around a handful of brands. Bodybuilding.com, Alani Nu, Vital Proteins, and Body Fortress repeatedly surface across platforms, while nearly one-third of the industry sees little or no AI presence at all.

The findings make it clear that AI systems are heavily influenced by credibility and accessibility of brand-related content. Well-structured product pages, authoritative reviews, and inclusion in top-tier media lists consistently drive visibility. Uniquely in this category, there is also a stronger tilt toward performance-oriented and community-driven content than what we see in broader supplement categories like Greens or Multivitamins.

By the Numbers

68%

of all AI mentions go to just 10 brands, leaving a large portion of the market invisible in AI search.

65%

of AI responses with sentiment above 90 mention Bodybuilding.com

20%

of Perplexity citations come from community-driven sources

These numbers highlight both the concentration of visibility and the unique role of community voices in shaping AI answers for protein supplements.

Why Certain Brands Show Up More Often

When looking across the platforms, it becomes clear that Protein and Performance brands surface based on three consistent levers. The first is presence in authoritative editorial content. Brands that are regularly included in “Best Protein Powder” or “Top Pre-Workout” roundups from Men’s Health, Women’s Health, Forbes, or Barbend appear more often in AI-generated answers.

The second lever is SEO and structured brand websites. Google’s AI Overviews regularly drew on brand-owned pages such as 1stPhorm.com, TransparentLabs.com, and LegionAthletics.com. These sites have strong keyword optimization and provide AI with clear factual details like ingredient lists and dosage guidelines.

Finally, reputation signals from consumer buzz make a difference. Brands like Bodybuilding.com and BPN benefit from exceptionally high sentiment scores, while others like Ascent or Axe and Sledge show up with lower sentiment, reflecting mixed reviews and consumer perception.

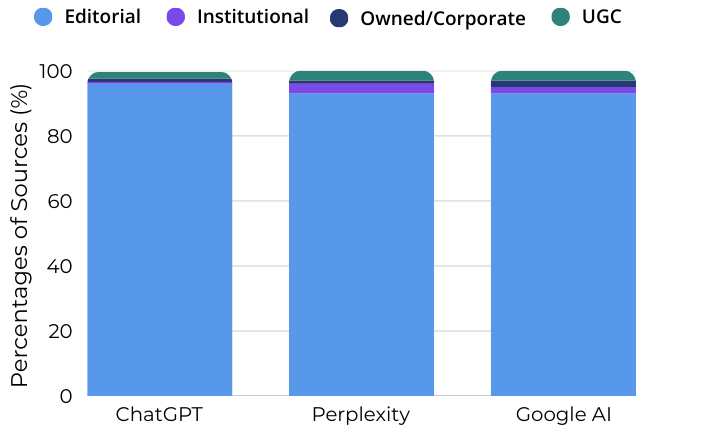

Source Type Mix by LLM

Our analysis of more than 400 citations across the three AI platforms shows a very different balance of source types depending on the LLM.

- ChatGPT relies overwhelmingly on editorial sources, with over 90 percent of its citations coming from expert reviews, media outlets, and publishers.

- Google AI Overviews splits its references more evenly, pulling about half from editorial content and nearly half from brand-owned websites. Institutional sources, such as universities or medical centers, appear occasionally but are not dominant.

- Perplexity offers the most balanced spread. While it leans on editorial reviews, it also cites a meaningful portion of user-generated content, making UGC nearly 20 percent of its citations in this vertical.

This breakdown underscores how Protein and Performance differs from gut health or multivitamins, where institutional citations are far more prevalent.

Source Types

To better understand these patterns, we classified sources into four categories:

- Editorial: Independent publishers, magazines, and expert review outlets. In Protein and Performance, this includes Men’s Health, Healthline, Forbes, and Barbend.

- Owned/Corporate: Brand websites, blogs, and product pages such as 1stPhorm.com, TransparentLabs.com, and LegionAthletics.com.

- UGC (User Generated Content): Community-driven platforms such as Reddit threads, bodybuilding forums, and comparison blogs.

- Institutional: Universities, hospitals, and medical centers. These appear less frequently in this category than in other supplement spaces.

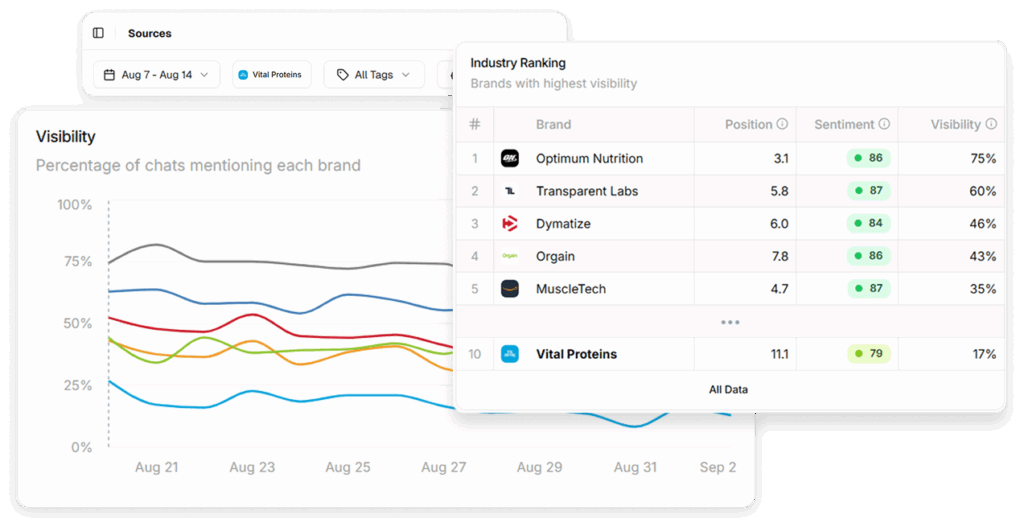

Visibility and Position: Who Shows Up, and Where

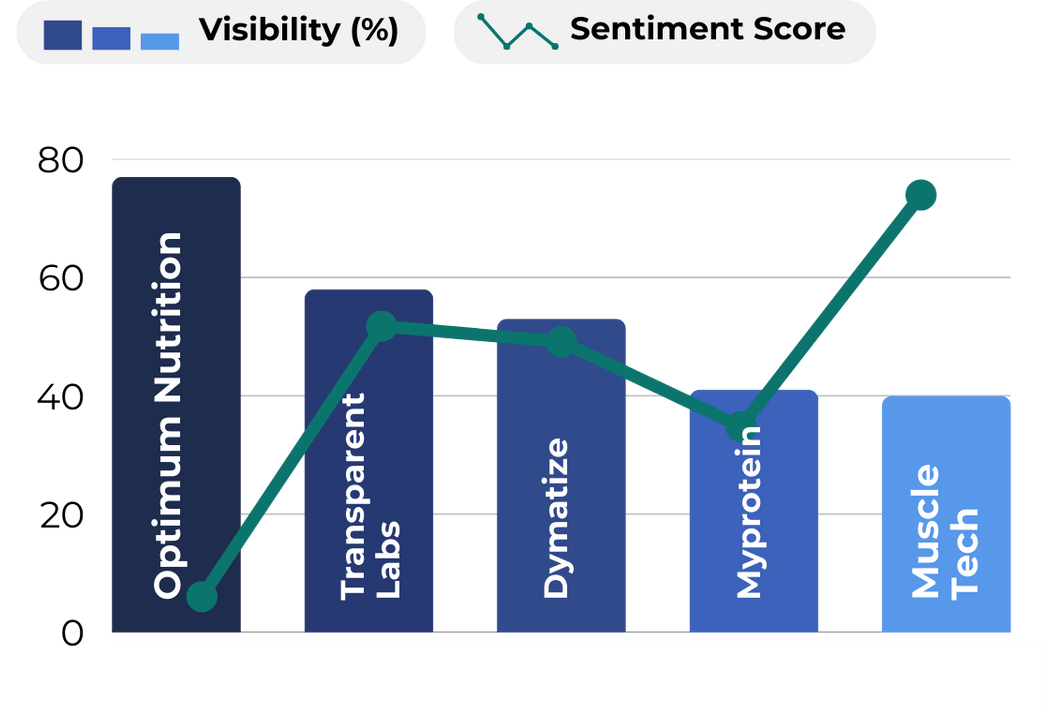

AI visibility is not only about how often a brand appears but also where it is positioned within an answer. A brand that consistently shows up at the top of AI results captures far more consumer attention than one that appears further down the list. Our analysis of the top ten Protein and Performance brands highlights several important dynamics:

- Optimum Nutrition leads in both visibility and placement. It holds the highest visibility score and an average position near the very top of AI responses.

- Transparent Labs and Dymatize perform strongly across both metrics. They are consistently present and often appear in favorable positions, reflecting effective SEO and positive coverage.

- MuscleTech appears less often but ranks higher when it does. Its results suggest depth of trust, even with lower overall frequency.

- Vital Proteins and Cellucor show solid visibility but weaker positions. They appear regularly, but AI systems tend not to prioritize them as top choices.

This comparison makes it clear that visibility alone does not guarantee brand strength in AI search. Positioning within results is a critical layer that shapes how consumers encounter and evaluate supplement brands.

What AI Trusts Most by LLM

Looking at specific patterns, each platform shows a unique set of “go-to” sources:

- ChatGPT most often referenced Men’s Health, Healthline, Barbend, and Forbes. These broad editorial authorities drive the bulk of its answers.

- Perplexity leaned on a blend, repeatedly citing FitnessVolt, bodybuilding forums, and supplement comparison blogs in addition to mainstream outlets. Its reliance on community voices is higher here than in other industries.

- Google AI Overviews often cited brand-owned sites such as 1stPhorm.com, TransparentLabs.com, and LegionAthletics.com. It combined these with a steady stream of editorial mentions, producing a hybrid of factual brand input and external reviews.

This trust mix shows why Bodybuilding.com, Vital Proteins, and Alani Nu consistently surface. They are not only present in expert lists but also optimized across their own brand pages, while benefiting from community and consumer-driven conversations that reinforce their credibility.

Conclusion

The Protein and Performance category demonstrates how AI search visibility is shaped by multiple layers of credibility. It is less about medical authority and more about reputation, structured information, and consumer trust.

Brands like Bodybuilding.com, Vital Proteins, and Alani Nu lead the pack because they have invested in visibility across multiple fronts: placement in authoritative reviews, strong optimization of brand-owned sites, and a presence in community-driven spaces. Others, like BPN, show that high sentiment can serve as a launch pad for greater AI visibility over time.

For brands seeking to increase their AI presence, the playbook is becoming clear. Secure placements in trusted fitness outlets, optimize owned content for clarity and crawlability, and encourage consumer buzz across forums and social platforms. AI is not inventing reputations. It is amplifying the consensus already present online. In the Protein and Performance industry, that consensus is formed through performance, trust, and visibility in the right digital spaces.

Download AI Visibility Report

Top Protein Brands

AI Z-Score Performance Rankings