The power of social influencers, particularly beauty influencers, is undeniable. Platforms like YouTube have become the go-to for consumers seeking authentic reviews, tutorials, and product recommendations. OG Influencers like Michelle Phan, Jeffree Starr, NikkieTutorials, and Jackie Aina have not only pioneered this space but have also redefined how beauty brands reach and engage with their audiences. These creators have transformed personal beauty routines into a global phenomenon, driving trends and determining the success of new beauty brands.

The shift from traditional marketing to influencer-driven content accelerated with the rise of short-form video platforms like TikTok, Meta Reels, and YouTube Shorts, where consumers now prefer to discover and validate beauty products through peer reviews and short-form video content rather than traditional search engines and blogs. This evolution has opened up new avenues for brands to tap into the power of social commerce, where the endorsement of a trusted influencer—or better yet, a niche creator—can trigger an impulse buy that not only leads to an instant sale but also gives users the instant gratification of feeling like they’re part of a larger trend or movement.

Current State of Beauty eCommerce

As of 2024, the global beauty and cosmetics market is projected to reach $312.33 billion, with online sales contributing a significant share of total industry revenue. In the U.S. alone, the beauty and personal care market is expected to generate $97.81 billion. These projections were published before the boom of social commerce platforms like TikTok Shop and Instagram Shop, highlighting the untapped potential of these channels.

Social commerce platforms are becoming increasingly influential, not just as trend drivers but as critical sales channels where the integration of shopping features allows consumers to purchase directly from the content they engage with, fueling the market growth.

Market Consumer Behavior and Pain Points

The modern beauty consumer is both informed and discerning, with 70% of online shoppers purchasing beauty products at least once a month. Young consumers, particularly those aged 18-34, are highly influenced by social media and the opinions of content creators. However, with the increased market saturation comes the challenge of standing out. Brands that fail to deliver personalized experiences risk capturing user interest, retaining consumer trust and loyalty.

Personalization is no longer a luxury but a necessity in 2024. Consumers expect ads and product recommendations tailored to their unique preferences. However, many beauty brands still make common marketing mistakes that lead to consumer frustration. For example:

| Common Mistake | Consumer Pain Point | Behavioral Impact |

|---|---|---|

| Overemphasis on Complex Ingredients | Consumers feel overwhelmed by technical jargon about ingredients | A 2023 Mintel report found that 58% of beauty consumers prefer brands that simplify ingredient lists and highlight clear benefits, with 42% avoiding products they don’t fully understand. |

| Over-Reliance on Macro Influencer Collaborations | Consumers perceive endorsements as inauthentic | A 2024 study by Influencer Marketing Hub shows that 72% of consumers feel more connected to micro-influencers, leading to higher engagement rates, as they perceive macro influencers as less relatable. |

| Failing to Fuel A Sense Of Community and Brand Loyalty | Consumers today seek deeper connections with brands | According to a 2024 report by Revieve, 68% of beauty consumers are more likely to remain loyal to brands that actively foster a sense of community, whether through social media engagement, loyalty programs, or interactive content. Neglecting this aspect can lead to higher customer churn and lower lifetime value. |

Social Commerce in Beauty

The rise of social commerce is transforming the way beauty products are marketed and sold. In the U.S., 71% of beauty shoppers now use specialty beauty retailer websites when researching new products. This shift highlights the growing importance of social media as a search engine, where consumers are more than likely to discover and research new products through platforms like TikTok, Meta, and YouTube.

These platforms have become key channels for online beauty purchases thanks to their innovative shopping features. TikTok’s algorithm-driven content discovery and YouTube’s long-form, in-depth reviews offer consumers a unique blend of entertainment and information. These platforms provide brands with a unique opportunity to engage with consumers exactly where they are, tailoring their approach to align with the consumers’ preferences and purchasing behaviors.

Subscribe to our Newsletter

Get exclusive strategies and insider insights to boost your influence.

The New YouTube Affiliate Program: A Potential Game-Changer

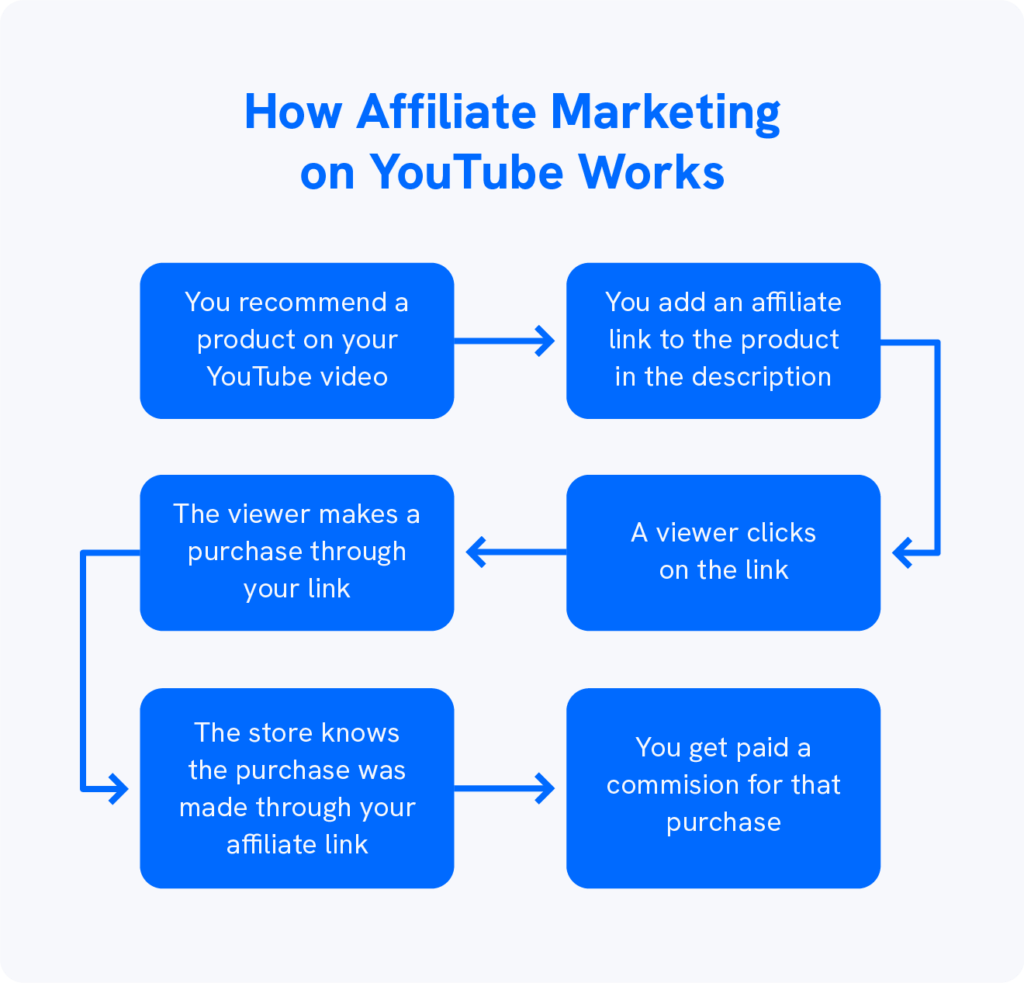

YouTube’s expansion of its affiliate program seemingly falls into place as a transformative force in beauty e-commerce, building on the success of TikTok Shop and the resurgence of Instagram as a key social commerce platform.

With this program, creators with over 20,000 subscribers can now feature products directly in their videos and Shorts, allowing seamless shopping experiences for viewers while earning competitive commissions similar to the success seen by its social competitors, where shoppable content has become a significant revenue driver.

Recent trends indicate a resurgence in the popularity of long-form content, a shift that YouTube is particularly well-positioned to capitalize on. To keep up with this evolving user preference, both TikTok and Instagram – traditionally known for their short-form content—have extended their video lengths to 15 minutes. As these platforms race to embrace content consumption trends, the key distinction lies in each channel’s demographics and the strategies brands employ to engage their audiences on each.

| Platform | Age Group | Gender Distribution | Top User Interest |

|---|---|---|---|

| TikTok | 18-24 (36.2%) | 49.2% Female, 50.8% Male | Entertainment, Music, Dance, Beauty, Fashion |

| META | Facebook: 25-34 (31%), Instagram: 18-34 (63%) | Facebook: 56% Male, 44% Female; Instagram: 51% Female, 49% Male | News, Shopping, Lifestyle, Travel, Food, Fitness |

| YouTube | 25-34 (21.2%) | 54.4% Male, 45.6% Female | Education, Entertainment, Music, Gaming, DIY, Product Reviews |

YouTube Affiliate is Just the Beginning

YouTube’s influence on the beauty industry remains strong, offering both brands and influencers unparalleled opportunities to reach and engage with consumers. As the platform continues to innovate with programs like the YouTube Affiliate Program, the potential for growth in beauty e-commerce is limitless.

Beauty brands and creators should explore and leverage new social commerce channels; however, with such an ever-changing and new marketplace, the strategies needed are one-of-kind. By partnering with social commerce experts, your brand won’t just follow trends—it will set them. Ready to uplevel your social commerce strategy? Talk to our team.