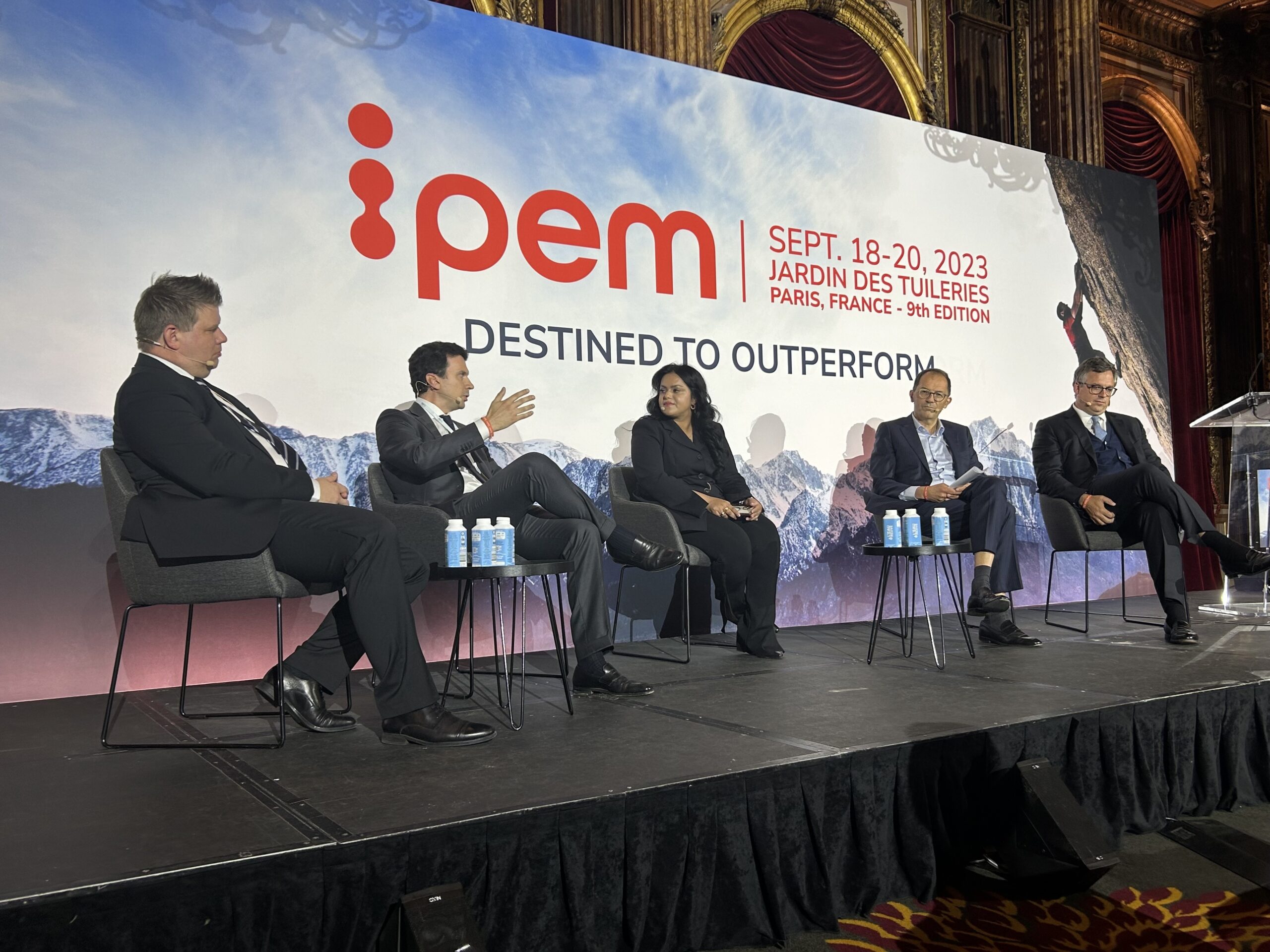

Staying ahead is crucial for professionals in Hedge Funds and Private Equity (PE). During the 2023 IPEM Women & Diversity in PE Summit, our Chief Public Affairs Officer Jessica Schaefer spoke on fundraising, risk management, and structural considerations and offered a valuable perspective on how strategic communications can help.

In 2023, the investment world witnessed a series of extraordinary events that reverberated throughout global markets. The challenges posed by a world emerging from a pandemic, coupled with shifting monetary policies and a major European land war created a complex and unprecedented environment. As we set our sights on 2024, the echoes of the past year continue to shape the investment landscape with profound implications for hedge funds and private equity firms.

The Dawn of Risk Aversion

One of the most prominent shifts we’ve witnessed is the surge in risk aversion among allocators. These allocators, encompassing institutional investors, pension funds, and high-net-worth individuals, have grown increasingly cautious in their capital deployment strategies. Scarred by the memories of the 2008 financial crisis and the economic upheaval unleashed by the COVID-19 pandemic, they have recalibrated their risk tolerance.

As a consequence, allocators are swiftly retreating from emerging investment opportunities, favoring established funds with a demonstrable track record and a robust risk management framework. For emerging funds seeking to attract capital and carve out a track record, this transition poses a considerable challenge.

Scrutiny Intensifies for Fund Managers

As risk aversion continues to limit capital deployment, fund managers are confronted with amplified scrutiny of organizational expectations. Beyond the merits of their investment strategy, fund managers must navigate a complex web of demands and due diligence imposed by allocators.

This heightened scrutiny extends to the fund manager’s organizational structure, governance, and compliance framework. Investors now insist on assurance that the fund is adept at managing an array of risks effectively. Transparency is no longer a choice; it is an imperative, with allocators seeking comprehensive and unambiguous reporting on fund performance, fees, expenses, and potential conflicts of interest.

Elevating Structural Considerations

One of the most notable transformations in fundraising is the newfound emphasis on structural considerations. Elements of fund management that were once relegated to the background are now occupying a central position in the minds of investors:

- Organizational Structure: Investors seek transparency in the fund’s team composition, key decision-makers, and succession plans as part of their due diligence process, recognizing that diversity, equity, and inclusion (DEI) within these aspects can be indicative of the fund’s commitment to long term stability and sustainable growth.

- Compliance and Risk Management: Scrutiny is directed at the fund’s compliance framework and risk management processes to ensure the ability to navigate turbulent market conditions.

- Transparency: Transparency is no longer negotiable. Fund managers must provide a comprehensive view of their operations to instill confidence in potential investors.

- Alignment of Interests: Investors increasingly seek alignment of interests between fund managers and themselves, spanning fee structures, co-investment opportunities, and the commitment of fund managers.

Navigating Unchartered Waters

While the challenges of fundraising are formidable, they are not insurmountable. Fund managers can adapt and thrive by fortifying their organizational structures, enhancing compliance measures, and prioritizing transparency. The path to securing capital now demands not only an all-weather investment strategy but also a robust framework to meet the more restrictive expectations of allocators.

As we embark on 2024, the investment landscape remains dynamic. Fund managers must remain agile, actively capitalizing on market opportunities, managing risk astutely, seeking fundamental value, and unwaveringly acting in the best interests of their clients.

With all of these challenges, the role of a strategic communications partner is critical. Expertise in storytelling, relationship management, crisis response, and market analysis can significantly enhance a fund’s ability to secure capital and flourish in the evolving investment landscape.

The Critical Role of a Strategic Communications Partner

The support of a strategic communications partner can be transformative. These professionals specialize in crafting and conveying your fund’s unique story and value proposition to both current and prospective investors. Here’s how they can make a substantial difference:

- Crafting a Compelling Narrative: Strategic communications experts collaborate with fund managers to construct a compelling narrative that showcases the fund’s strengths, investment approach, and track record. They articulate the fund’s mission and vision in a manner that resonates with investors.

- Building Investor Confidence: Investor trust is paramount. Strategic communications partners assist in building and maintaining investor confidence by providing transparent and consistent messaging that reassures investors about the fund’s stability, risk management, and long-term commitment.

- Effective Investor Relations: Strategic communications professionals can help manage relationships with current investors, ensuring regular updates, addressing concerns, and maintaining open lines of communication. This fosters a positive and enduring relationship, enhancing the likelihood of repeat investments.

- Managing Crisis Communications: Unexpected challenges may arise in the investment world. A strategic communications partner is adept at handling crisis communications, mitigating damage, managing investor expectations, and preserving a positive fund image.

- Tailoring Messages to Target Audiences: Different investors have distinct priorities and preferences. Communications experts tailor messages to various target audiences, whether institutional investors, high-net-worth individuals, or other stakeholders. Customization ensures that each group receives relevant information.

- Enhancing Online Presence: An online presence is imperative in the digital age. Strategic communications professionals optimize the fund’s online visibility through well-designed websites, engaging social media content, and informative newsletters, attracting and retaining investors in a competitive landscape.

- Market Intelligence and Analysis: Strategic communications partners provide valuable market intelligence and analysis, offering insights into market trends, investor sentiment, and competitive positioning. This empowers fund managers to make informed decisions and adapt fundraising strategies.

Never Miss a Chance to Get Ahead

Every leader needs a trusted team of strategic advisors as they navigate challenges in a rapidly changing world. Experience firsthand how the right team can make an impact on your brand and business performance – to request a consultation today, Contact Us.