See Which Greens & Gut Brands Rank in AI

AI is reshaping how brands are found – dictating what consumers see, trust, and ultimately buy. Visibility within AI systems now impacts every stage of the customer journey, influencing traffic, reputation, and revenue.

Who’s Winning in AI Search? A Deep Dive into Greens & Gut Health Brands

AI search is quickly becoming the new front door for product discovery. Whether it is ChatGPT recommending supplements, Perplexity pulling from expert reviews, or Google’s AI Overviews summarizing top picks, the question is: which Greens and Gut health brands are showing up, and why?

We analyzed 56 leading brands across the top AI platforms in this AIVx Mini Report, weighting results from ChatGPT (50%), Google AI Overviews (30%), and Perplexity (20%). The findings are clear: visibility is concentrated among a small set of brands, sentiment is consistently positive, and success is closely tied to how a brand shows up in online content.

The Big Picture: AI Mentions Are Uneven

AI assistants do not distribute attention equally. The top 10 brands captured about two-thirds of all AI mentions, while more than 20 percent of brands did not appear even once.

At the very top sits Athletic Greens (AG1). AG1 was referenced in nearly 78 percent of answers, far ahead of the next group of brands such as Amazing Grass, Bloom Nutrition, and Live it Up, which showed up in roughly 40 to 50 percent of results.

In practice, this means that when consumers ask AI tools about Greens powders, AG1 is nearly always part of the answer.

Key Findings & Insights

67%

Top 10 brands captured 67% of all AI mentions; 12 had none.

78%

AG1 led with 78%, far above the next brand.

145

Unique sources — ChatGPT cited 145 without repeating any.

Why Certain Brands Show Up More Often

Placement in Authoritative Content

Brands that are consistently featured in “Top 10” lists and expert reviews are far more likely to be surfaced by AI. AG1, Amazing Grass, and Garden of Life all appear widely across mainstream and niche outlets.

SEO and First-Party Content

Google’s AI Overviews in particular often cited brand-owned websites. Bloom Nutrition’s site, for example, was used multiple times. Well-structured FAQs, ingredient breakdowns, and health claims on brand websites often become source material.

Reputation and Social Buzz

AI reflects consensus. Brands with strong reputations, influencer attention, and positive media coverage are prioritized. Bloom and Live it Up are good examples: despite being newer, they achieved high visibility due to strong consumer chatter and glowing press reviews.

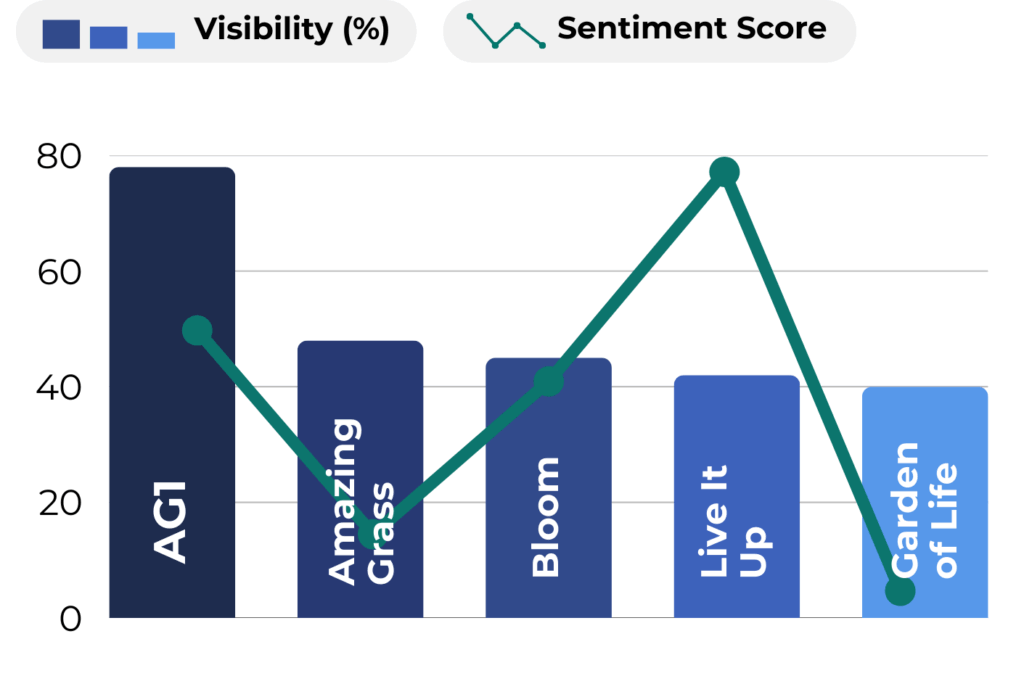

Visibility vs Sentiment

This chart shows AI visibility compared with sentiment for the top five Greens and Gut brands.

Insights:

- AG1 has the highest visibility but not the highest sentiment.

- Live it Up shows the highest sentiment score (83) despite lower visibility than Bloom.

- Bloom and Amazing Grass both fall into a mid-range where their visibility is strong but sentiment trails slightly.

The key takeaway is that visibility and sentiment do not always move together. A newer brand like Live it Up can build strong positivity online, which sets it up for future visibility growth.

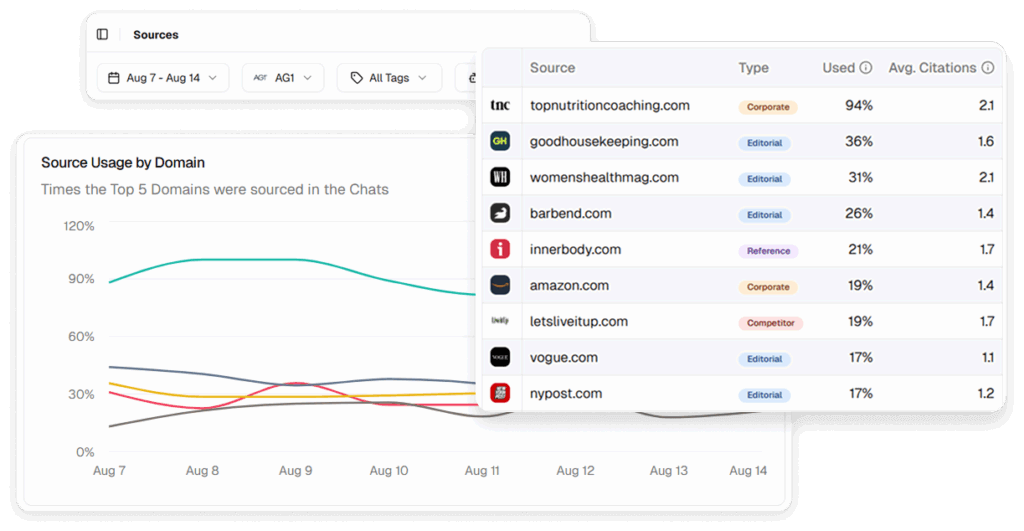

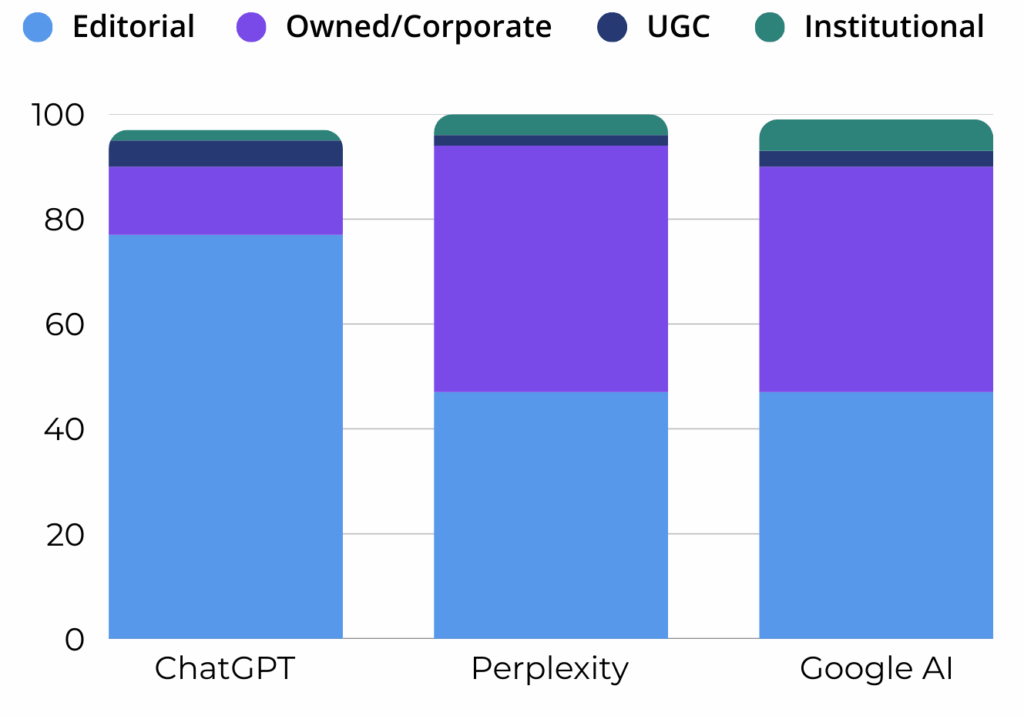

Source Type Mix by LLM

We analyzed 4 different types of sources and their citation distribution across ChatGPT, Perplexity, and Google AI.

Source Types

- Editorial: Independent publishers, magazines, and expert review outlets. These include sources like NY Post, Good Housekeeping, or Vogue. They carry authority because they are perceived as objective reviewers or journalists.

- Owned/Corporate: Brand-owned websites, corporate blogs, product landing pages, and e-commerce sites like Bloomnu.com, Amazon, or 1stPhorm.com. These give AI factual details such as ingredients, claims, and pricing directly from the source.

- UGC (User Generated Content): Community-driven platforms like Reddit, forums, and product review boards. These reflect consumer sentiment and real-world experiences but are less structured than editorial or corporate content.

- Institutional: Sources tied to universities, hospitals, medical centers, or scientific organizations. Examples include HopkinsMedicine or MedicalWestHospital. These carry credibility for health claims and provide the clinical backbone to AI’s answers.

Insights:

- ChatGPT is driven mostly by editorial sources (77 percent). It rarely cites brand-owned or institutional sources.

- Perplexity is split almost evenly between editorial (47 percent) and owned or corporate sources (47 percent), showing its bias toward curated product review sites and direct brand mentions.

- Google AI uses a blend of editorial (47 percent), owned/corporate (43 percent), and institutional sources (6 percent), reflecting the health focus of the category. It is the only platform consistently citing hospitals and medical institutions.

This finding is unique to the Greens and Gut industry. Health and credibility matter more here than in categories like fashion or tech, which explains why Google AI leans into institutional sources while also balancing brand-owned content.

What AI Trusts Most

- ChatGPT: Relied on New York Post reviews, Wikipedia entries, Vogue, and gut health blogs.

- Perplexity: Frequently cited routines.club, TheQualityEdit, Cosmopolitan, and Innerbody.

- Google AI: Tapped into HopkinsMedicine, MedicalWestHospital, CustomMarketInsights, and brand-owned sites such as Bloomnu.com.

Key Takeaways for Greens and Gut Brands

- Be present in “best of” lists and authoritative reviews so AI has credible references for your brand.

- Invest in SEO and structured first-party content because Google AI often pulls facts directly from brand sites.

- Build positive reputation and buzz since AI visibility aligns with favorable consensus and ignores unknowns rather than criticizing them.

- Tailor coverage across platforms because ChatGPT, Perplexity, and Google each prioritize different types of sources.

- Secure health authority validation since medical sites and institutional sources appear in this vertical more often than in categories like fashion or tech.

Final Word

AI search is already shaping how consumers discover Greens and Gut supplements. The brands that show up most often, like AG1, Bloom, Amazing Grass, and Live it Up, earned visibility by saturating authoritative reviews, building SEO-friendly content, and generating consistent positive coverage.

For other brands, the path forward is clear. Invest in authoritative mentions, strengthen your owned content, and create reputation signals that align with consumer trust. AI is not inventing preferences. It is amplifying the consensus of the web.

In the Greens and Gut industry, if AI is not talking about you, consumers probably will not be either.

Download AI Visibility Report

Top Greens and Gut Brands

AI Z-Score Performance Rankings