See Which Children’s Vitamins Brands Rank in AI

AI is reshaping how brands are found – dictating what consumers see, trust, and ultimately buy. Visibility within AI systems now impacts every stage of the customer journey, influencing traffic, reputation, and revenue.

The AI Vitamin A-List: Which Children’s Brands Get the Spotlight?

AI search is now one of the first places parents turn when asking about the best vitamins for their kids. Whether it’s ChatGPT, Perplexity, or Google’s AI Overviews, the question is the same: which brands do these AI platforms recommend most often, and why?

We analyzed 43 leading children’s vitamin brands across these three AI tools in this AIVx Mini Report, weighting results from ChatGPT (50%), Google AI (30%), and Perplexity (20%). The findings show that just a handful of brands capture most of the attention, while many are barely visible.

By the Numbers: Eye-Catching Stats from the Study

The data revealed some standout figures that illustrate just how concentrated AI visibility really is in this category. These three numbers frame the landscape in a way that every marketer should pay attention to:

86%

SmartyPants was mentioned in nearly 9 out of 10 AI answers.

69%

The top 10 brands captured over two-thirds of all mentions, while 8 brands (19%) were invisible.

200+

Google’s AI drew from more than 200 distinct sources, far broader than ChatGPT (145) or Perplexity (61).

Why Certain Brands Show Up More Often

Authoritative Lists & Reviews

Brands like SmartyPants, MaryRuth’s, and Garden of Life appear repeatedly in parenting magazines and health blogs.

SEO & Owned Content

Google’s AI frequently cites brand websites. HiyaHealth.com and MaryRuthOrganics.com each appeared multiple times.

Reputation & Buzz

Newer brands such as Hiya and First Day earned glowing coverage, showing that positive sentiment fuels AI visibility even for younger players.

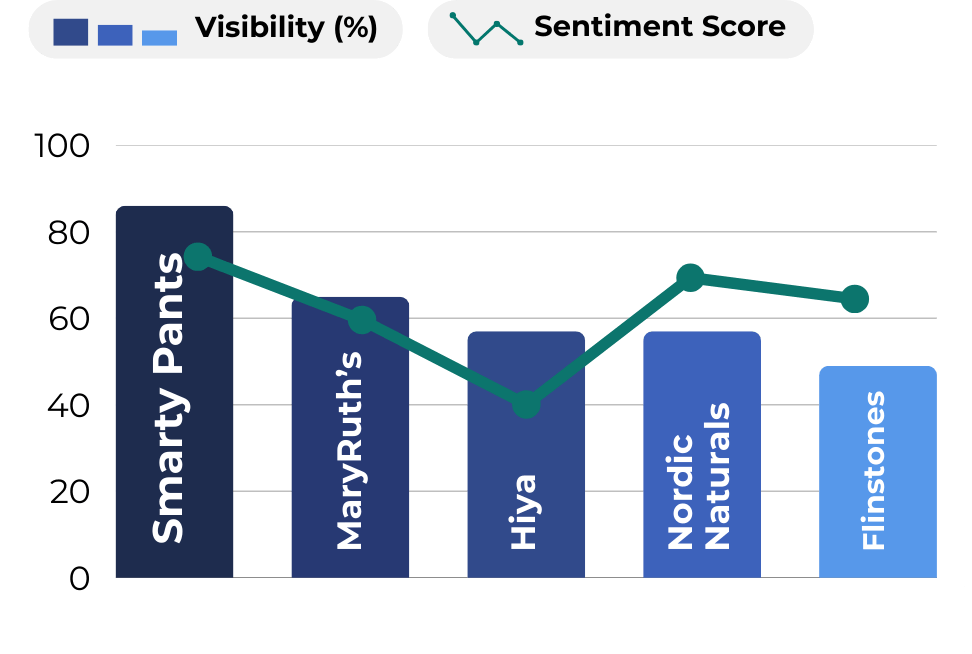

Visibility vs Sentiment

Not all visibility is created equal. Some brands are widely mentioned but with neutral tone, while others enjoy glowing praise despite fewer mentions.

- SmartyPants: High visibility, solid sentiment (~76/100).

- Hiya: Lower visibility, but the highest sentiment (83/100) thanks to praise for its no-sugar formula.

- MaryRuth’s & Nordic Naturals: Balance of strong mentions and high positivity, sitting in the sweet spot for trusted brands.

- Thorne: Limited mentions (~18%) but top-tier sentiment (83/100) — proof that niche credibility can shine even if reach is smaller.

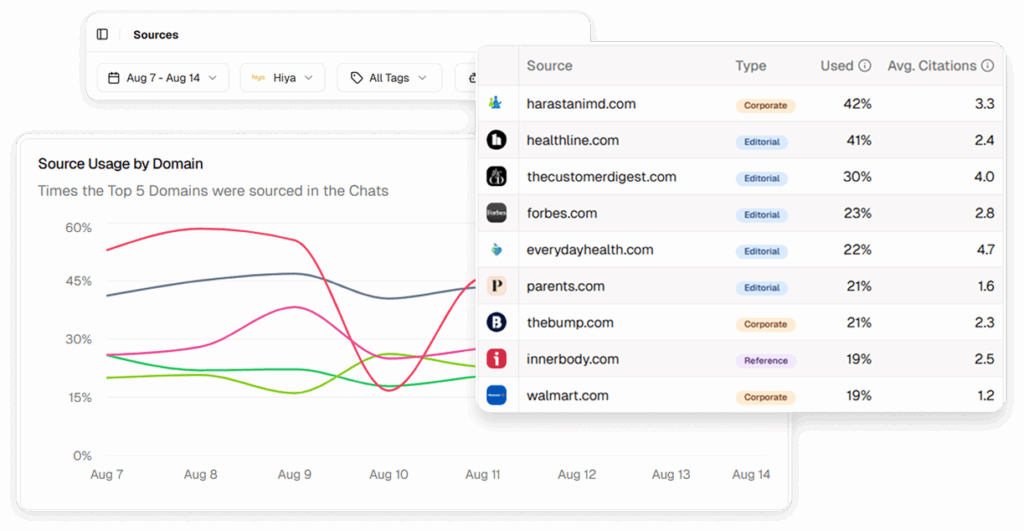

Visibility vs Editorial Source Dependence

Where AI gets its information from matters. Brands differ not just in how often they are mentioned, but in how much those mentions depend on editorial coverage.

- SmartyPants, MaryRuth’s, Nordic Naturals – Strong visibility backed by heavy editorial presence.

- Hiya – High visibility but much lower editorial dependence, relying more on its SEO-optimized brand site.

- Garden of Life & Flintstones – Consistent editorial mentions across health and parenting outlets.

- First Day – Low visibility and low editorial share, suggesting more reliance on owned content without enough outside validation.

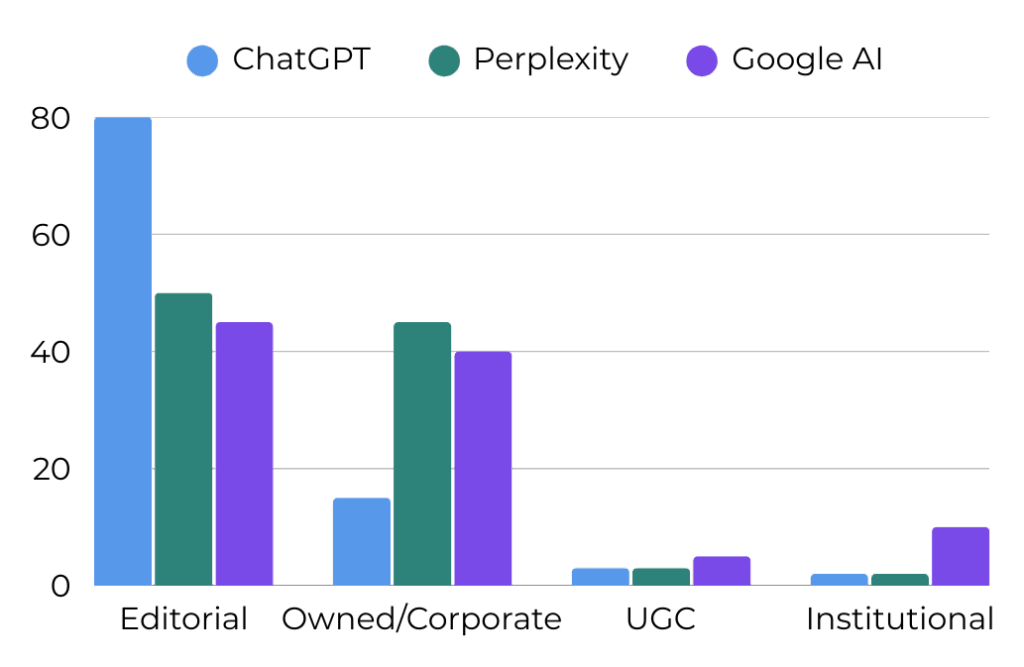

Source Type Mix by LLM

The way each AI platform selects sources is just as important as which brands it recommends. To understand these differences, we classified citations into four categories:

- Editorial: Independent publishers, magazines, and expert reviews. For Children’s Vitamins, this includes Parents.com, Forbes Health, and Everyday Health.

- Owned/Corporate: Brand websites, blogs, and product pages such as HiyaHealth.com, MaryRuthOrganics.com, and Amazon listings.

- UGC (User Generated Content): Parenting forums, Reddit discussions, and comparison blogs that capture real parent experiences.

- Institutional: Universities, hospitals, and medical centers. Examples include the Cleveland Clinic and NIH, which appeared more often here than in categories like performance supplements.

Insights

- ChatGPT depends almost entirely on editorial content (80%), pulling from parenting magazines, blogs, and health publications.

- Perplexity splits evenly between editorial (50%) and owned content (45%), often pairing review lists with brand FAQs.

- Google AI is the only one to consistently include institutional sources (10%), reflecting its bias toward health authority. It also blends editorial (45%) and owned (40%) in near equal measure.

This last point is important — Google is the only platform that consistently weaves in institutional sources, underscoring that credibility and clinical authority are critical for a children’s health product.

Takeaways for Children’s Vitamin Brands

The study highlights clear lessons for brands that want to break into AI-driven recommendations.

- Earn editorial validation – Get placed in trusted “best kids’ vitamins” lists.

- Strengthen owned content – AI pulls FAQs, ingredient pages, and schema markup directly from brand sites.

- Create buzz – AI amplifies positive consensus; silence is worse than criticism.

- Match platform patterns – Editorial for ChatGPT, owned+reviews for Perplexity, credibility+SEO for Google.

- Secure health authority validation – Institutional endorsements (pediatricians, hospitals) boost trust with both parents and AI.

Closing Thought

AI search is already shaping how parents discover children’s vitamins. The winners – from SmartyPants to MaryRuth’s and Hiya – earned visibility through reviews, structured content, and reputation. If AI isn’t talking about your brand, neither are the parents searching for it.

Download AI Visibility Report

Top Children Vitamin Brands

AI Z-Score Performance Rankings