Generative AI is changing how consumers discover, trust, and choose financial brands. According to Avenue Z’s 2025 Fintech Digital Banks AI Visibility Index, just ten digital banks now control over 83% of visibility across ChatGPT, Perplexity, and Gemini. These aren’t just high-traffic sites; they’re the brands AI recommends most often when users search for terms like “best mobile bank” or “no-fee checking.”

Ranking the Top Digital Banks by AI Visibility

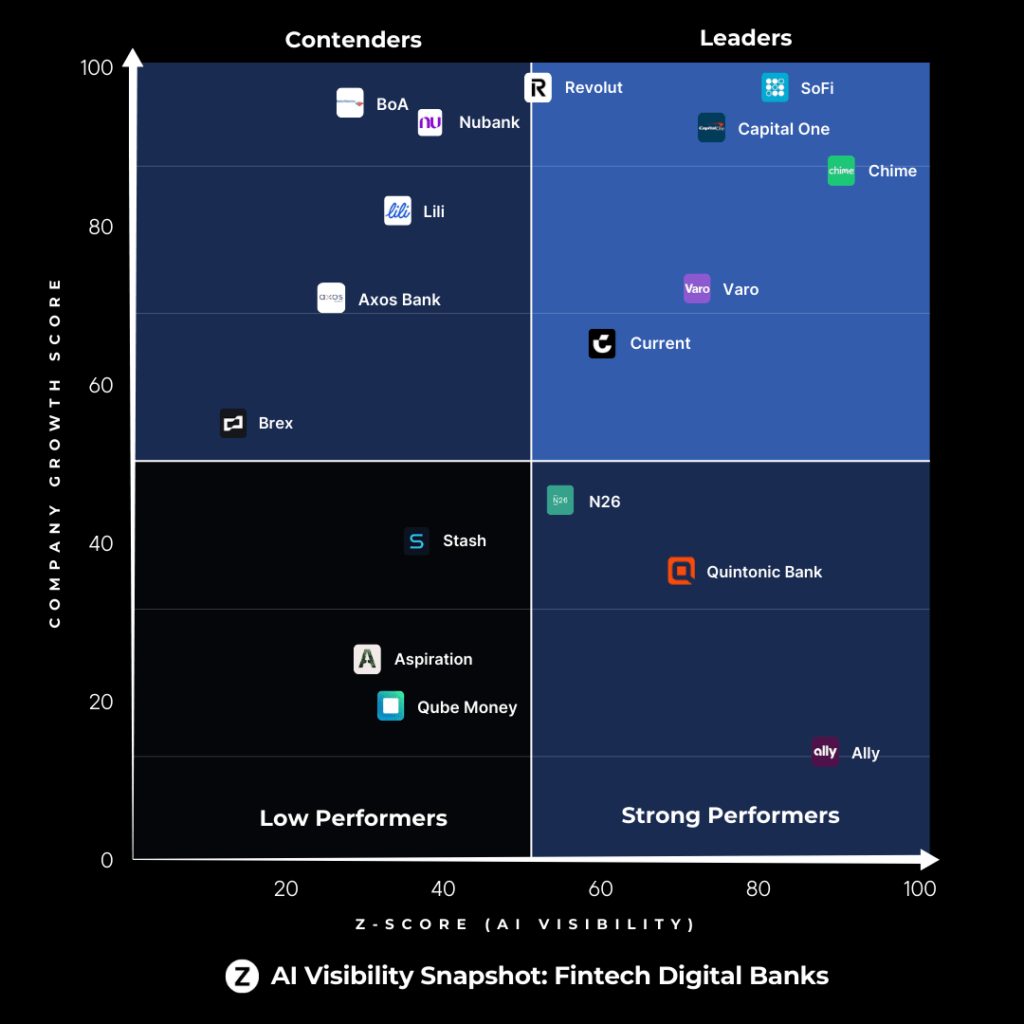

We’ve analyzed 60 fintech Digital Banks / Neobanks to uncover who leads in AI visibility across ChatGPT, Perplexity, and Gemini, and why most are falling behind.

Table of Contents

Here’s a closer look at the top 10, what’s fueling their visibility, and how other banks can catch up:

1. Chime

Z-Score: 96.5

Website: chime.com

Who They Are: A neobank known for no-fee banking, early direct deposit, and overdraft protection. Chime markets itself as a financial ally for younger, mobile-first users.

Recent Press: Just cited in PYMNTS, Banking Dive, Ad Age and more for its plans to go public in 2025, instant loan product launch, and standout NBA commentator ad.

Why It Ranks: Chime appears in nearly every AI-generated list of top digital banks thanks to consistent framing, clear benefits, and a wide content footprint.

2. Ally Bank

Z-Score: 90.5

Website: ally.com

Who They Are: A full-service online bank offering savings, loans, auto financing, and investing—known for strong APYs and responsive digital UX.

Recent Press: Featured in WSJ and Bankrate for its top-rated high-yield savings account and new flat-rate cash back credit card, solidifying its reputation as a leading digital bank for everyday financial tools.

Why It Ranks: Ally’s structure as a fully chartered digital bank helps it surface in a range of AI queries. Its strong domain authority and well-organized content give it a boost across platforms.

3. SoFi

Z-Score: 90.2

Website: sofi.com

Who They Are: Originally a student loan platform, SoFi has expanded into a complete financial ecosystem—offering banking, investing, insurance, and even credit cards.

Recent Press: Featured in PYMNTS, Business Insider, and CNBC for its sponsor bank partnership with Mesh Payments, inclusion in top bank rankings, and plans to reintroduce crypto investing post-regulation.

Why It Ranks: SoFi’s broad category presence makes it eligible for multiple AI prompts—from “best apps for student loans” to “mobile banking with investing.”

4. Discover Bank

Z-Score: 87.9

Website: discover.com

Who They Are: Best known for its credit cards, Discover also operates a high-performing online bank with strong savings accounts and personal loan offerings.

Recent Press: Covered by Business Insider, Yahoo Finance, and Reuters for its broad deposit offerings, digital banking services, and the approved Capital One merger—cementing its position as a major player in the evolving online banking space.

Why It Ranks: Discover benefits from authority signals and wide brand familiarity. It’s often cited in AI as a trusted, secure option with long-standing digital credibility.

5. Chase

Z-Score: 77.8

Website: chase.com

Who They Are: A traditional banking giant with a robust digital offering, Chase has invested heavily in its mobile app and online services.

Recent Press: Featured in CBS News, The U.S. Sun, and Business Insider for its $3,000 account bonus offer, fraud prevention initiatives, and recognition as one of the top banks for savings and customer service.

Why It Ranks: Though technically a legacy bank, Chase’s massive web presence and structured content keep it competitive in AI search—especially around full-service banking prompts.

6. Bank of America

Z-Score: 77.7

Website: bankofamerica.com

Who They Are: One of the “Big Four” U.S. banks, BofA has rolled out mobile-first features like Erica, its AI-powered assistant, to keep pace with fintech challengers.

Recent Press: Covered in Yahoo Finance, MarketWatch, and PYMNTS for insights on long-term stock performance, consumer spending trends, and macroeconomic commentary—reinforcing BofA’s influence across financial markets and consumer behavior.

Why It Ranks: Its authority as a traditional institution gives it baseline visibility, but lack of tailored digital narratives limits its performance compared to neobank peers.

7. Credit Sesame

Z-Score: 74.4

Website: creditsesame.com

Who They Are: A credit-focused platform offering free credit scores, debt tracking, and now a digital bank product focused on financial empowerment.

Recent Press: Featured in Finovate and FinTech Futures for its $51M funding round, acquisition of Zingo, and partnership with TransUnion to launch a direct-to-consumer credit education platform—spotlighting its growth in the financial wellness space.

Why It Ranks: Its consistent framing around credit-building and educational resources earns it inclusion in prompts about financial health and beginner-friendly banking.

8. Wells Fargo

Z-Score: 70.5

Website: wellsfargo.com

Who They Are: A traditional bank with a large physical footprint and strong consumer awareness. Its digital app and mobile banking efforts are robust.

Recent Press: Featured in CNBC and AdvisorHub for its investment insights on corporate bonds and plans to open 20 new branches in New York City, reinforcing Wells Fargo’s focus on growth and market leadership.

Why It Ranks: Authority and scale drive visibility—but its lack of specific product narratives keeps it from topping the AI charts.

9. Varo Bank

Z-Score: 69.4

Website: varomoney.com

Who They Are: The first consumer fintech granted a national bank charter, Varo offers no-fee checking, early payday, and cash advance tools.

Recent Press: Covered in Yahoo Finance, FinTech Futures, and Banking Dive for its fee-free high-yield banking, nationwide bank status, and plans to leverage AI and machine learning to drive profitability.

Why It Ranks: Varo benefits from its consistent messaging around inclusivity and cost savings—ideal fodder for AI answers about fee-free banking.

10. Axos Bank

Z-Score: 67.9

Website: axosbank.com

Who They Are: A lesser-known but fully licensed digital bank offering checking, investing, personal and business banking.

Recent Press: Featured in Business Insider, CNBC, and Fortune for its top-rated high-yield savings options, business account perks, and recognition as one of the best online banks for both consumers and entrepreneurs.

Why It Ranks: Axos combines strong technical optimization with a clear category role—helping it appear in prompts about alternatives to traditional banks.

What Is a Z-Score… and Why Does It Matter for AI Visibility?

The Z-Score is Avenue Z’s proprietary visibility metric that measures how often a brand appears in AI-generated responses across platforms like ChatGPT, Perplexity, and Gemini.

It reflects a blend of:

- Frequency: How often the brand is surfaced in relevant prompts

- Consistency: Whether it appears across multiple AI platforms and prompt categories

- Authority Signals: How often it’s mentioned by high-trust sources that AIs cite

A score of 100 doesn’t mean a brand appears in every result, it means it leads the category in visibility and recommendation strength. The closer to 100, the more dominant a brand’s presence in AI discovery.

What Other Brands Can Do to Improve AI Visibility

1. Lock in a Clear Identity. AI favors brands that know who they are: neobank, credit-builder, ESG bank, etc., and repeat that framing across all content.

2. Build Content AI Can Use. Create pages that directly answer consumer questions. Think FAQs, comparisons, help articles, and structured blogs.

3. Prioritize Trusted Media. Coverage in NerdWallet, Bankrate, and Business Insider influences AI more than generic PR hits. Focus on outlets LLMs actually cite.

4. Structure for Discovery. Schema, fast-loading pages, HTTPS, and responsive mobile experiences all impact how and where you show up.

5. Monitor Your Share of Voice. Track how often you appear in AI answers—then optimize what’s missing.

AIO is the new SEO, and the competition is fierce.

Read the Full Report or Contact Avenue Z to see how your brand can climb the ranks in AI search.