Forget everything you know about organic traffic. When users ask ChatGPT, Gemini, or Perplexity to “compare crypto wallets” or “find the most trusted blockchain for DeFi,” they’re not browsing a list of links. They’re reading curated summaries from a handful of high-authority sources (and most of the industry isn’t making the cut).

In Q1 2025, just 10 blockchain brands captured over 91% of all AI citations. Coinbase, Ethereum, and Binance alone accounted for more than a quarter of the total visibility.

This is the AI Visibility Index for Blockchain: a proprietary benchmark showing which blockchain companies are winning in AI search and why the rest are being left behind.

Who’s Winning AI Search in Blockchain?

We’ve analyzed 60 blockchain companies to uncover who leads in AI visibility across ChatGPT, Perplexity, and Gemini, and why most are falling behind.

What Is the AI Visibility Index?

The AI Visibility Index is Avenue Z’s proprietary framework for measuring how often a brand appears in AI-generated search results—and why. This report analyzed 60 blockchain brands over a 90-day period across more than 100 real-world AI prompts spanning ChatGPT, Gemini, and Perplexity.

Each brand’s Z-Score reflects weighted performance across five key signals:

- Share of Voice across platforms

- Top-tier media citations

- Technical site performance

- Sentiment in AI-generated content

- Structured content and page diversity

It’s not just a search report; it’s a snapshot of brand power in the new AI-first era of discovery.

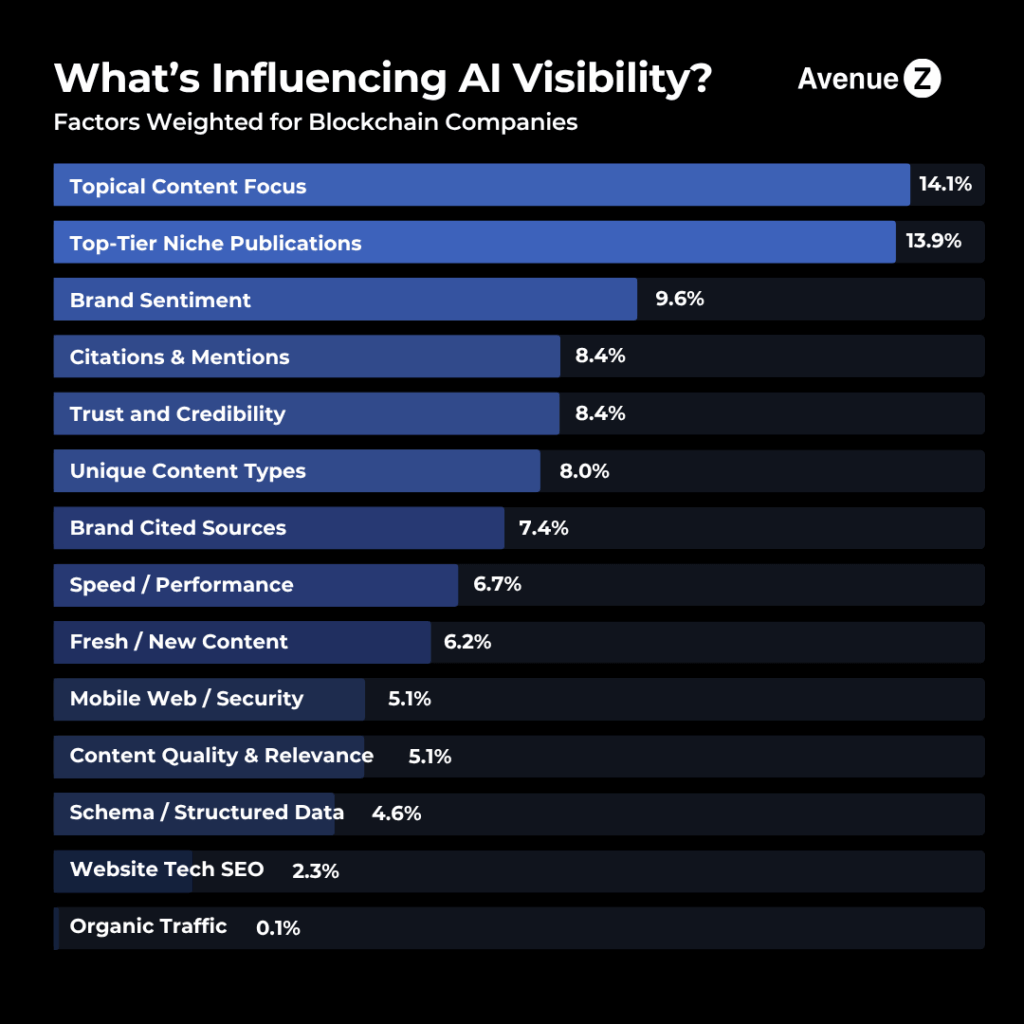

Key Signals That Drive AI Visibility in Blockchain

Our analysis revealed five consistent visibility drivers:

- Topical Content Focus Leads Everything: AI platforms prioritize brands that publish content aligned with user intent. Whether it’s tokenization, compliance, or ecosystem adoption, brands that cover high-value topics in depth are far more likely to appear in generative answers.

- Top-Tier Niche Publications Outperform General Media: Mentions in trusted, blockchain-specific outlets carry more weight than broader press coverage. AI favors sources with contextual authority—meaning where you’re cited matters just as much as how often.

- Positive Sentiment Gives Brands a Lift: Brands with stronger sentiment in AI responses tend to rank higher. The top-performing companies in this index averaged a 67% positive sentiment score, proving that favorable framing influences AI model selection.

- Mentions Alone Aren’t Enough Without Credibility: Citations and trust signals carry significant weight—but only when backed by relevance. Cardano, for example, had over 5,800 mentions yet still ranked just 31st, reinforcing that not all press moves the AI needle.

- Content Variety and Credible Sources Multiply Impact: Top-ranking brands like Coinbase and Fireblocks showed up with six or more unique content types cited—ranging from blog posts and whitepapers to documentation and tutorials. That depth, paired with citations from their own websites, made them go-to answers for AI.

What the Data Reveals

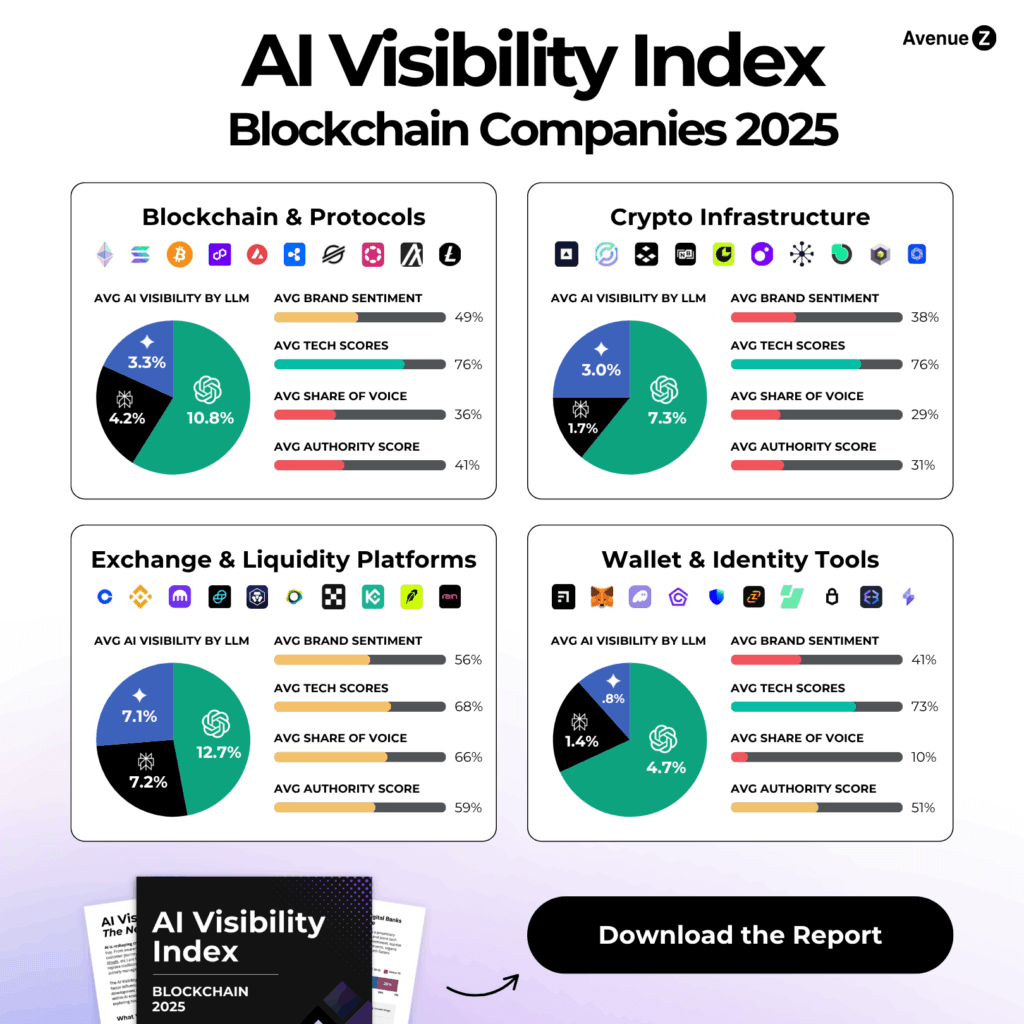

- AI visibility is heavily concentrated—just 10 blockchain brands control over 91% of Share of Voice across major platforms.

- Half the industry is virtually invisible—30 companies scored below 1% visibility across ChatGPT, Gemini, and Perplexity.

- Exchange platforms dominate—with 66% average Share of Voice and the highest authority scores, they’re the most visible segment across AI search.

- Wallets and identity tools are falling behind—despite high technical readiness (73%) and decent authority scores (51%), their average AI visibility is just 0.8%, revealing a clear messaging and citation gap.

- Developer-led content continues to outperform—platforms like Solana and ConsenSys show strong presence in Perplexity and Gemini, driven by technical documentation, integrations, and tutorials.

- AI models favor educational and solution-focused assets—homepages, product explainers, and evergreen educational content remain the most commonly cited sources across all blockchain segments.

Why Blockchain Companies Should Care

AI is no longer a future consideration. It’s the default discovery channel. According to Gartner, traditional search volume will drop 25% by 2026 as generative AI replaces keyword-based behavior.

For blockchain companies, this shift means:

- The gap between leaders and challengers is widening fast

- If you’re not showing up in AI, you’re missing users at the top of the funnel

- Technical site health isn’t enough—authority, clarity, and sentiment drive visibility

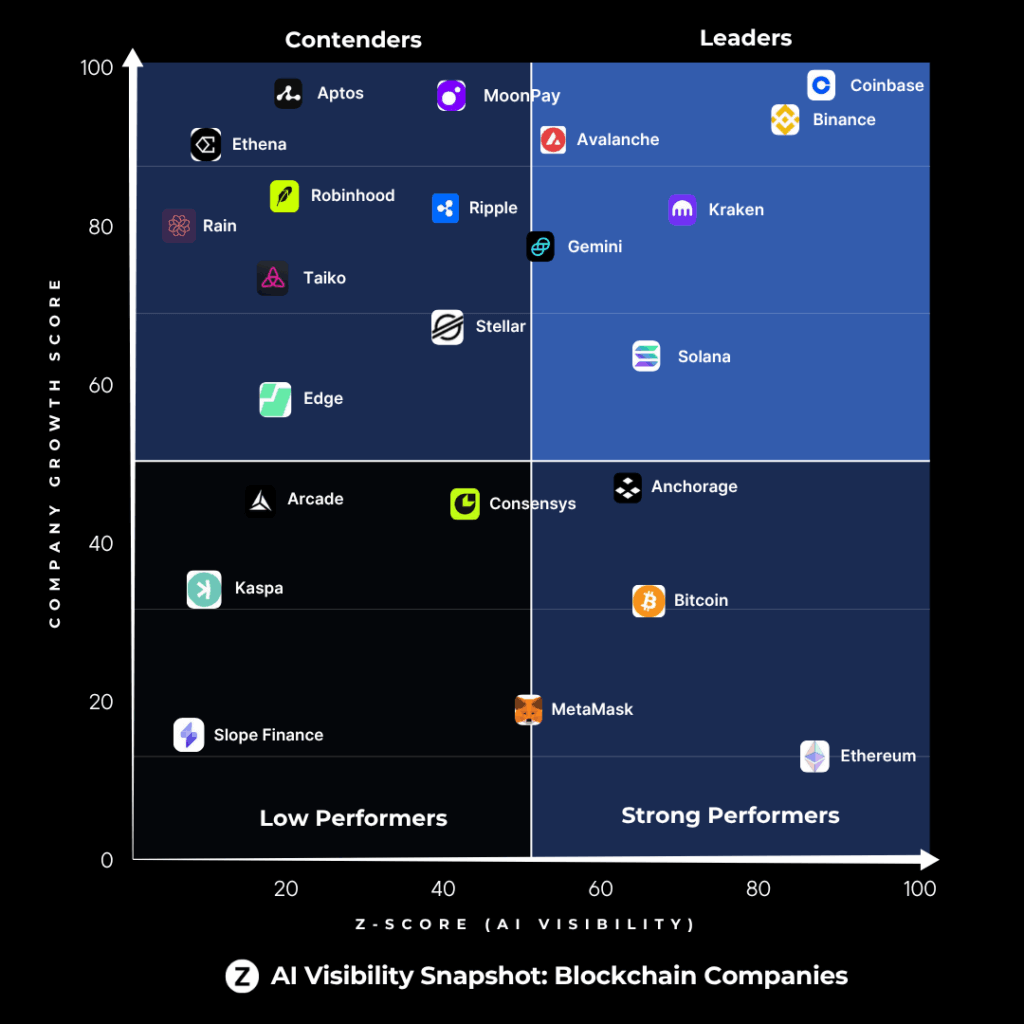

Who’s Leading and Who’s Being Overlooked?

Top Performers

Brands like Coinbase, Binance, Kraken, and Avalanche lead the pack—combining high AI visibility with strong company growth scores. These are the brands AI models trust and users search for, especially in categories like custody, liquidity, and exchange infrastructure.

Rising Players

Companies such as MoonPay, Ripple, Robinhood, and Aptos show strong momentum and market presence but haven’t fully broken through in AI visibility—yet. With the right content and citation strategy, they’re well-positioned to move into leadership territory.

Opportunity Zone

Brands like Ethereum, Bitcoin, and MetaMask rank high in AI visibility but low in company growth scores—suggesting that while they dominate in awareness, they’re not gaining traction at the same rate as fast-growing challengers.

What Digital Banks Can Do Right Now

To increase AI visibility, Web3 brands should:

- Audit your content across all platforms—especially docs, blog posts, and product pages

- Structure your content for AI discoverability using schema and NLP-aligned formatting

- Secure coverage in AI-cited outlets like CoinMarketCap, Investopedia, and PYMNTS

- Build content clusters around key AI prompt topics like security, tokenization, compliance, and scalability

- Track visibility as a KPI, not just SEO or media volume

Want to See Where You Rank?

Download the full report to see how 60 leading blockchain brands perform across the AI discovery ecosystem and what it takes to compete.

Get the Full Report here. Or request a custom audit.